Current location:

Home > News > Company News > Popular science | This article takes you to what is high-frequency tradingPopular science | This article takes you to what is high-frequency trading

In recent years, with the expansion of the breadth and depth of the application of IT technology in the financial market, the structure of investors and trading methods are undergoing structural adjustments, and program trading, algorithmic trading and high-frequency trading have become more and more The preferred transaction method for financial institutions. At present, in the international stock, foreign exchange and futures markets, high-frequency trading accounts for more than 50%, 25% and 20% respectively, which has had an important impact on the ecology of the international financial market. With the listing of stock index futures and the emergence of the previous comprehensive trading platform (CTP), the technical foundation of domestic futures high-frequency trading has also been gradually formed and has ushered in rapid development.

In general, high-frequency trading, derived from programmatic trading and market-making mechanisms, refers to the analysis of price change patterns in high-frequency trading data through extremely high-speed supercomputers, and the use of these price change patterns to profit. Usually high-frequency trading takes advantage of the geographical location of the server to obtain market conditions and execute a large number of trading orders in a relatively faster time, so as to obtain profit margins that are difficult to obtain in ordinary trading methods.

Compared with traditional low-frequency trading, high-frequency trading has the characteristics of fast execution speed, short position holding time, small single transaction volume, frequent transactions, and cross-market transactions. The average income of each transaction of high-frequency traders is often relatively limited. By adopting high-frequency trading to capture more opportunities and improve risk control methods, profits can be increased. In addition to high-frequency trading, what we often hear is quantitative trading. Quantitative trading is a synthesis of various techniques for investing in quantitative methods. High-frequency trading is only a small branch of quantitative trading. Due to its high capital utilization efficiency, the potential rate of return is very high.

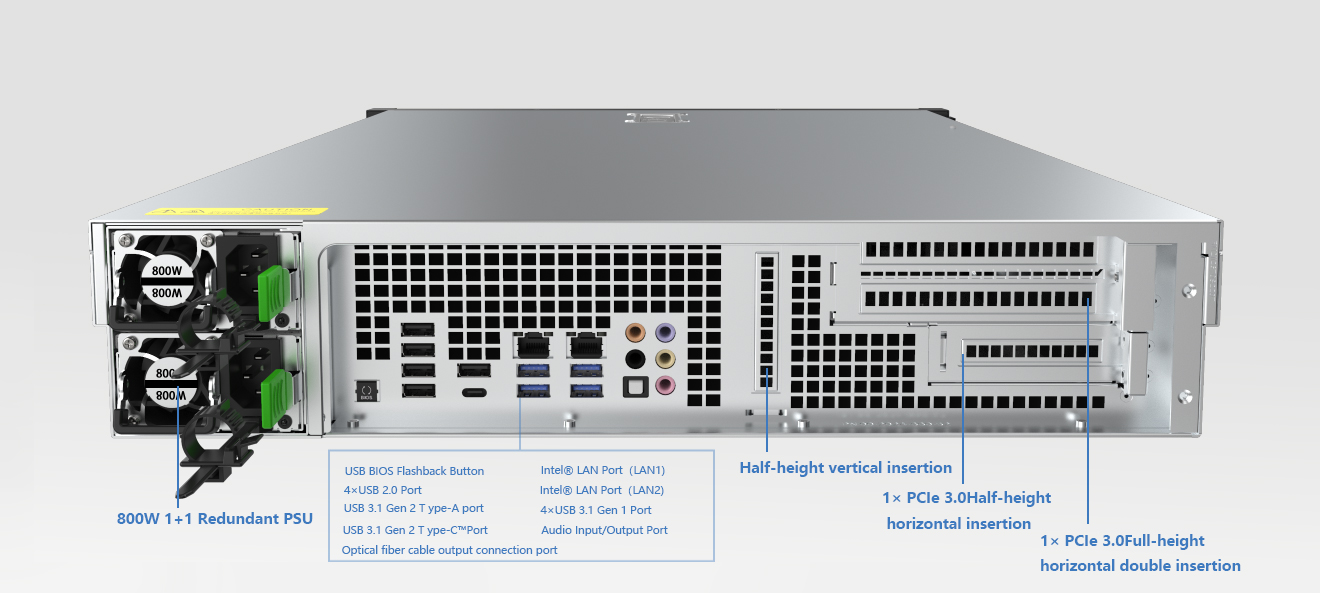

Financial high-frequency trading requires extremely high real-time computing on the server, and all order processing needs to be completed in a shorter time than others. This requires the server not only to provide the most powerful single-core and full-core ultra-high-frequency capabilities, but also the network port to have ultra-low-latency processing capabilities compared to conventional network cards to ensure the real-time computing requirements of the entire link. Reduce latency, compute at high speed, and maximize transaction process efficiency to get ahead.

Under the long-term high-load operation of the server, a large amount of heat will be generated, and the high-frequency trading server uses a high-frequency CPU, and the power consumption is as high as 350W or more, which will inevitably cause the internal chassis temperature of the server to be too high. On the other hand, under normal circumstances, the CPU will experience frequency hopping when the CPU is running at the limit speed. Therefore, this requires that the server needs to make systematic optimization adjustments in terms of heat dissipation and frequency stabilization.

Based on this situation, Gooxi has launched a light and shadow high-frequency trading server. Aiming at the application requirements for continuous and stable high-frequency operation of the server and ultra-low response delay in the high-frequency trading process, the system delay is up to 30% lower than that of the traditional server, so as to achieve nanosecond time advantage for customers and better investment decisions for investors. More time and space to operate. The overall hardware of the server adopts the optimal combination and system optimization, and squeezes the main frequency of each 1Hz of the CPU to the limit, which effectively improves the customer experience and helps customers to further seize the market opportunities.

With the continuous development of China's securities market, the level and depth of China's capital market has been continuously improved, such as the open night market of the stock market, ETFs and margin financing and securities lending that directly or disguisedly realize T+0 transactions with primary market redemption and credit transactions. With the launch of innovative products such as standard, high-frequency trading is gradually being used by some institutions in the trading of these products. It is believed that the segmented investment field of high-frequency trading will usher in a new round of development. Traders will bring certain development opportunities. Combined with the advantages of high reliability, high security and high cost performance of Gooxi high-frequency trading server, it will lead a new wave of high-frequency trading equipment innovation. In the future, Gooxi will actively explore advanced acceleration solutions for high-frequency trading servers, and strive to seize market opportunities such as futures for customers with lower latency and more stable frequency.

Leading Provider of Server Solutions

YouTube